NYCU BDAF guest lecture

With the kind invitation of Martinet at Quantstamp/Zircuit, I gave a guest lecture at NYCU in Taiwan for the Blockchain Development and FinTech course, on May 6. I took the liberty to define the nature my talk, one that situates the advent of decentralized consensus networks in a bigger picture. I challenged myself to trace things back 100 years, back to when Hitler became the leader of the reestablished Nazi party. Why?

“Chancellor on brink of second bailout for banks” was engraved into the genesis block of Bitcoin. This industry was born from the invention of a global digital ledger that explicitly wishes to disassociates itself from the governments of the world. Why? On the streets, one would have no trouble finding a large number of answers - the issue with the dollar’s worth, US debts and so on. Case in point, just over the last few days the industry’s timeline is filled with comments about the downgrade of US credit rating and the rising of bond yields.

Yet, this industry cares enormously about what the regulators think. News about ETF approvals stroke the nerves of market participants. A system that was created to operate fiercely independently in spite of governments are valued by investors closely watching the sentiment of governments toward said system. That is a fascinating paradox.

All in all, I wish to dig into the history about the tanglement of money, US fiscal policy, and geopolitics. Gain my own perspective. And share my learning with the students.

History fascinates. One can depth-first-search endlessly in the literatures. History also dwarfs. There are so much interdependent factors at work that I am afraid any of my attempts to connect some dots in support of specific arguments are doomed to be premature.

But I reconsidered. A while ago I stumbled upon Bird by Bird by Anne Lamott, a book about how to write:

We were out at our family cabin in Bolinas, and he was at the kitchen table close to tears, surrounded by binder paper and pencils and unopened books on birds, immobilized by the hugeness of the task ahead. Then my father sat down beside him, put his arm around my brother’s shoulder, and said “Bird by bird, buddy. Just take it bird by bird.”

I decided that it’s ok to take the convoluted history bird by bird. It’s ok to share my embeddings in-flight, as I rummage through my input data.

The following captures the talk in cleaned up text form.

Thank you Martinet for the graceful introduction. Originally I wanted to give you guys some ideas about decentralized systems and consensus. But, I thought that we are in a very interesting time, and blockchain is not just a technology for the sake of technology, it actually has lots of implications in the big big picture. So I thought it would be very useful to tell you what I see at the big picture level, what does that mean to blockchains and beyond.

Debt & Currency

So I wanted to start with the idea of debt and currency which are extremely old ideas dating back to at least 5000 years ago.

But let’s just go back by 100 years. In 1925, Hitler came out of prison. He went to prison because he attempted a coup against the Weimar government and failed. He was sentenced to 5 years in prison but was very quickly bailed out. In 1925 he came the Nazi party leader. Mein Kempf is the book he wrote in the prison, where he talked about his struggle and his political ideology, which is a widely read book and banned because it obviously contributed to the massacre of Jews.

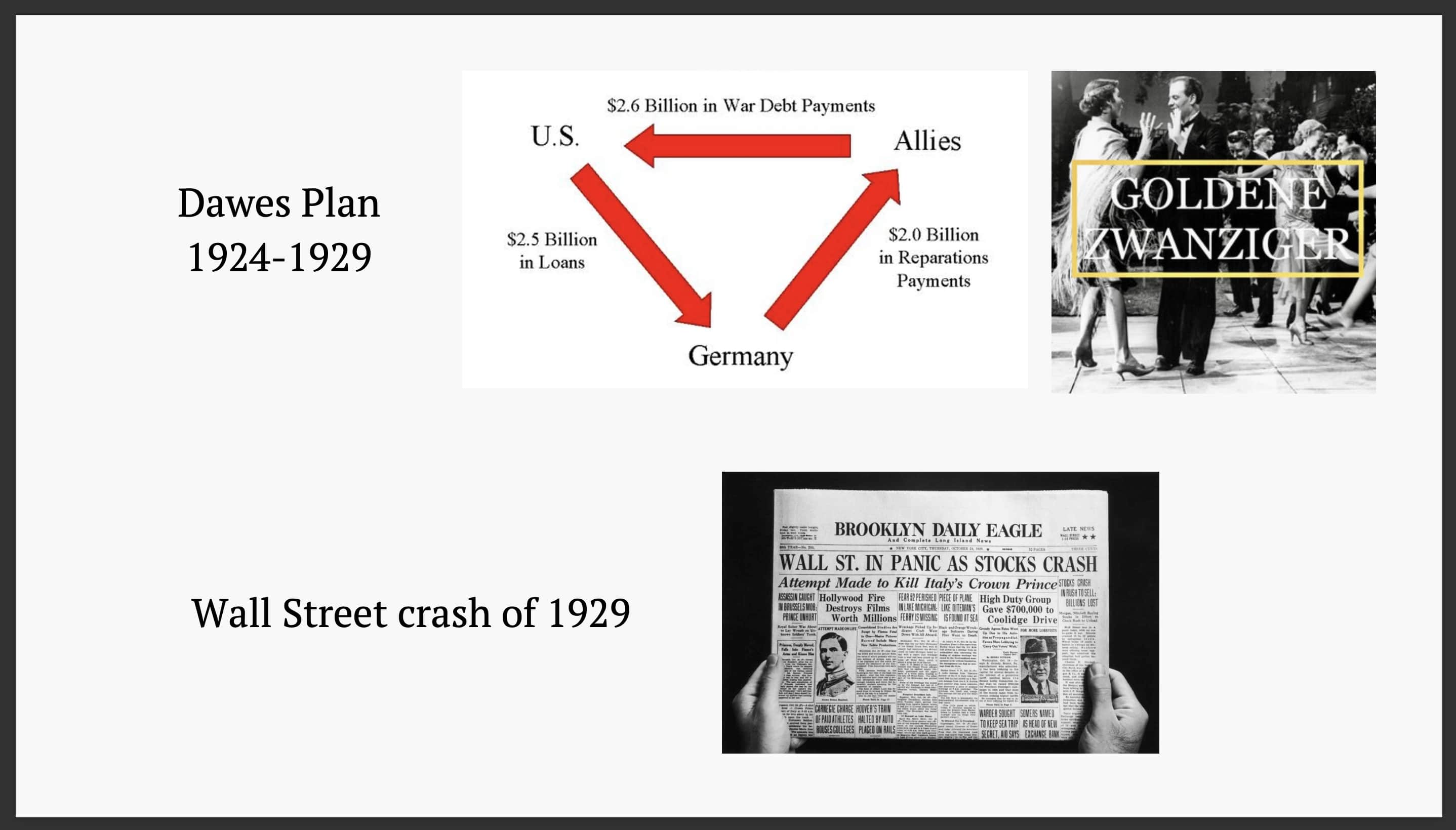

Going to 1929. What happened in 1929 was a bunch of things. But we have to cover the Dawes Plan. Basically Germany came out of the WWI, losing the war, owing a lot of money to the Allies countries. So Germany had to pay for the reparations for other European countries. That put a lot of pressure on the German economy. Therefore a plan was in place for the US to loan money to Germany to pay for the reparations. Because of this loan, the economic pressure was relieved and that actually caused a golden period, the Goldene Zwanziger, where the economy was booming. That was when the hyperinflation just receded around 1923. But what happened in 1929 was that the Wall Street crashed. If you’re American and your economy is not doing so well, the first thing you would cut is paying the country that just lost the war. So the US cut down their loans to Germany and asked for repayments sooner, causing the German economy to deteriorate very quickly. So that was the historical context where the Nazi rose.

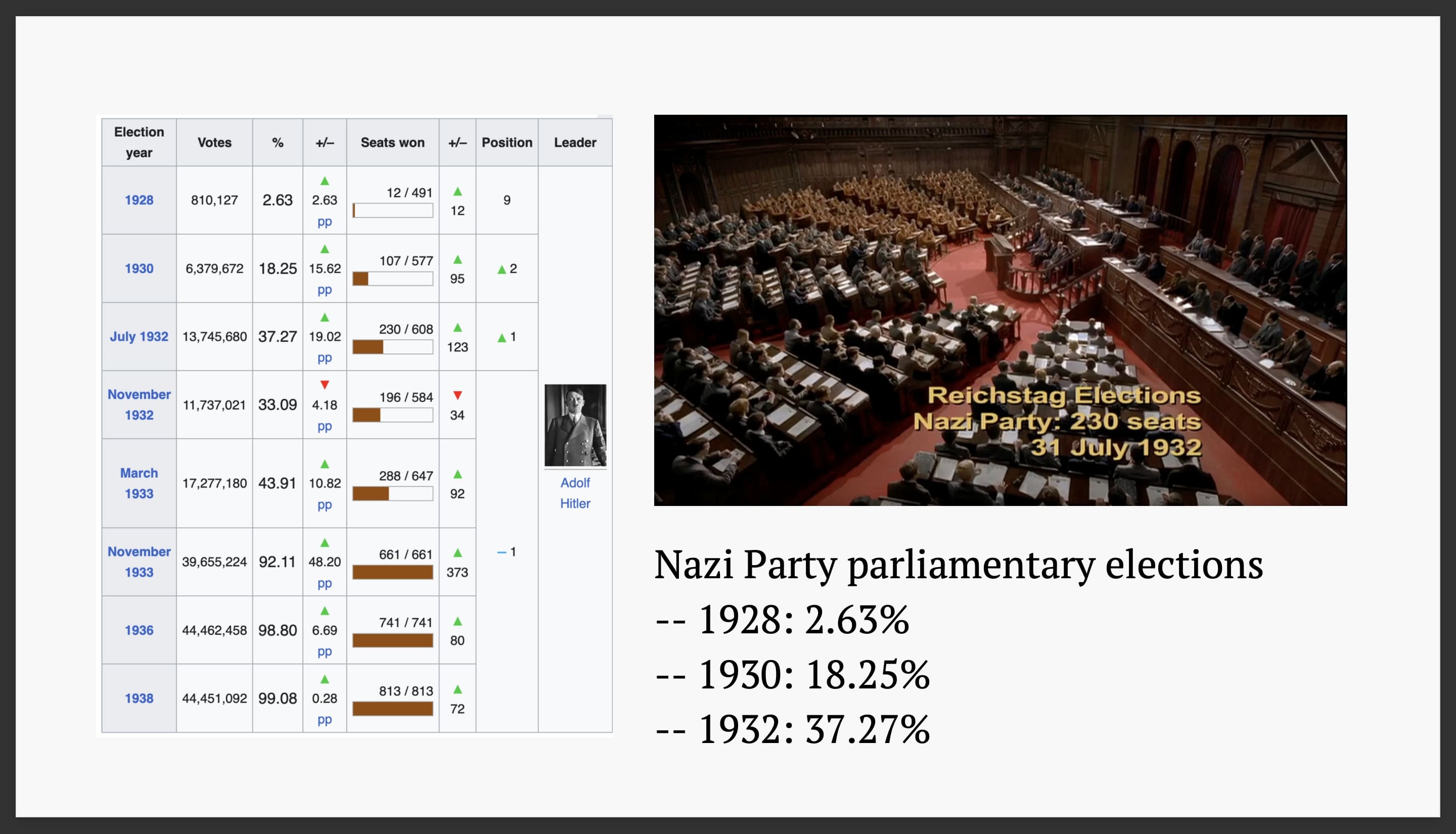

If you look at these election results of the Nazy party at the German parliamentary. In 1928, the Nazi party got 2.6% of the parliament. Already in 1932, just four years later, it’s got 37% of the parliamentary. It was a very fast rise.

That ultimately resulted in 1933 where Hitler was appointed the chancellor of Germany by the president, Hindenburg, who was a very old man (85 years old). Before Hitler became Chancelor, there were two more Chancelors that were trying to keep Hitler out of the office, but the German economy was doing so badly, they couldn’t really change it. And in a democracy, you are supposed to make decisions based on the people’s will, and with Nazi party’s rise in the parliamentary, that basically meant the Nazi represented the people’s voice. Due to the rule of democracy, it was almost inevitable that the Nazi party leader became the Chancelor.

Article 48 of the Weimar Constitution basically meant that before Hitler became the Chancelor, the parliamentary was blocking so many laws from passing, obviously Nazi being very much at odds with other parties. They couldn’t reach consensus and the parliamentary broke down all the time. If you have a parliamentary breakdown, no laws can be passed, the government basically stops operating. So Article 48 was the idea that in extraordinary time, the president can sign special laws that go into effect immediately, bypassing the congress. But that means the democracy was failing, which further incited people’s anger, espeically the people that were under Hitler’s influence.

One thing that is tragically interesting to note is that in 1925 Hitler was ordered by the court to not give public speech for two years. Because Hitler was great at public speeches and so great at making people angry and follow what he said. His public speech was dangerous. The court ordered he could not give public speeches. In fact, he attempted the coup, and treason warrants the death sentence. But he actually gave public speeches at the court which changed the opinions and he go sentenced to 5 years and came out in mere 9 months. So that was a demonstration of his ability to influence and trigger the madness of the crowd, a central topic of the WWII.

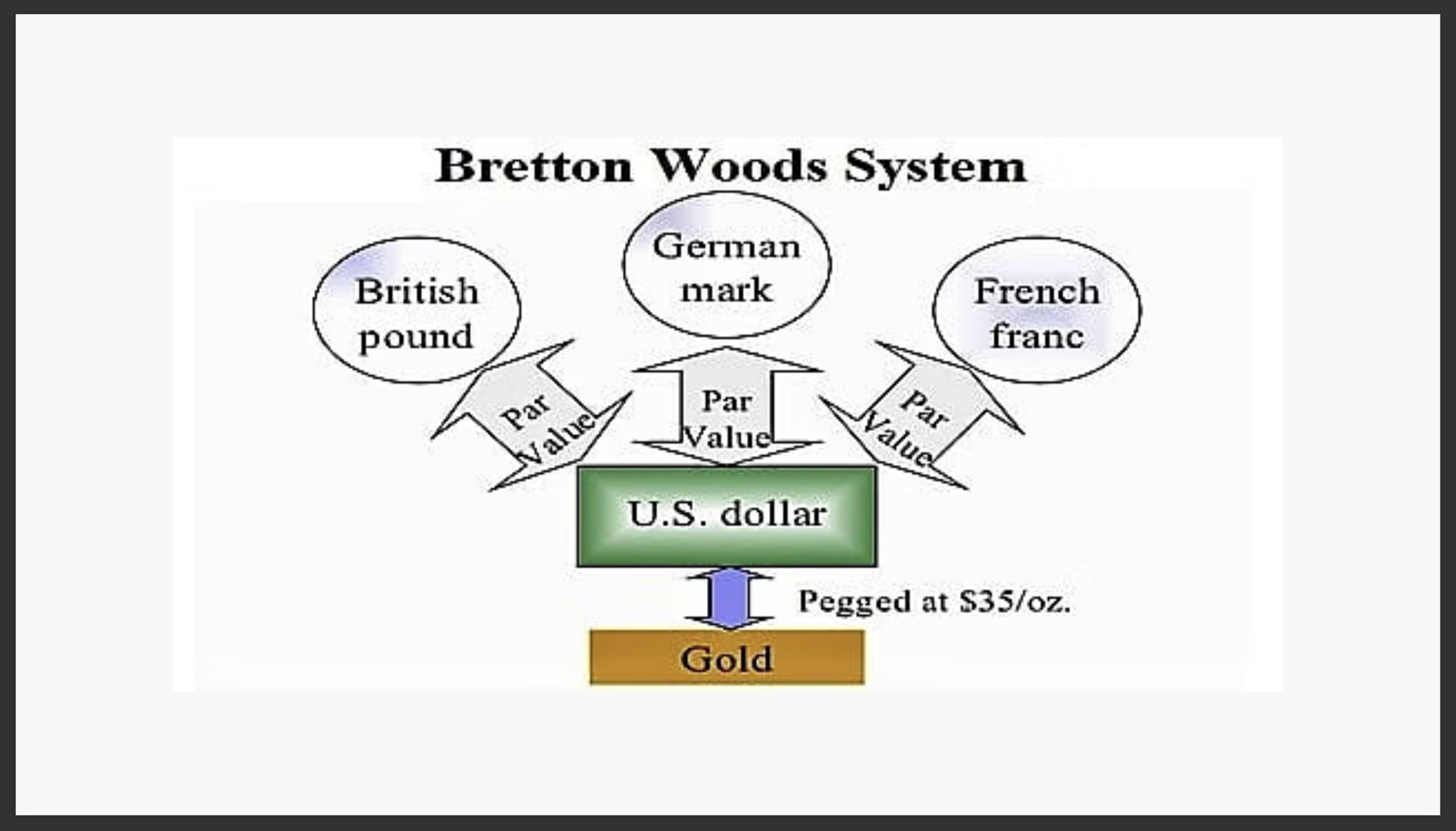

WWII happened. Fast forward to 1944. Germany was losing. At the time of the Normandy Landing, on June 6, 1944, another very famous conference that was quietly happening but determining the world order after the war was the Bretton Woods Conference, between June 1st and 22nd, 1944. It happened in this very old and shabby hotel where the leaders of many countries came to talk about “so what are we going to do with our money after the war?” Because, in a sense, Germans started the war because there was tremendous monetary problems and the order of money. In order to prevent another war from happening - 50 million people died from WWII - let’s find a much better world order for international monetary system.

What’s interesting is in 1940, Nazi was imagining that they would win the war and they were already imagining how they would design the international monetary order. They came up with this idea of a gold backed system, which ultimately became the gold-backed system decided at the Bretton Woods Conference.

What’s also interesting is before the gold-backed system was decided, another system was considered. What’s problematic about currencies is that you have a country that is importing a lot but exporting a little, or vice versa, you have problems where the currencies are either unfair to country A or country B. So the best idea is for countries to import and export the same amounts of different goods and commodities. So the first proposal at the conference was - let’s design a system that incentivizes countries to balance their trades. If you have unbalanced trades, you would be punished by the system. But it was obviously rejected because the US had massive trade imbalance and they thought “we won the war, so we want the system to work in favor for us, not against us. We don’t want a international monetary order that is punishing us right out of the war.”

So eventually we came to this Bretton Woods system. The idea is that gold is rare and everyone wants gold. Gold is cleraly the desire of all human beings. Let’s use gold as the ultimate value denominator. Let’s fixed the US dollars to one ounce of gold exchanged for 35 US dollars as a constant. And let’s negotiate fixed exchange rates between the US dollar and each of the currencies of other nations. So all the rates were determined at the conference, obviously a lot of politics were involved, based on who contributed and who had stronger voices. But this was the order coming out of WWII.

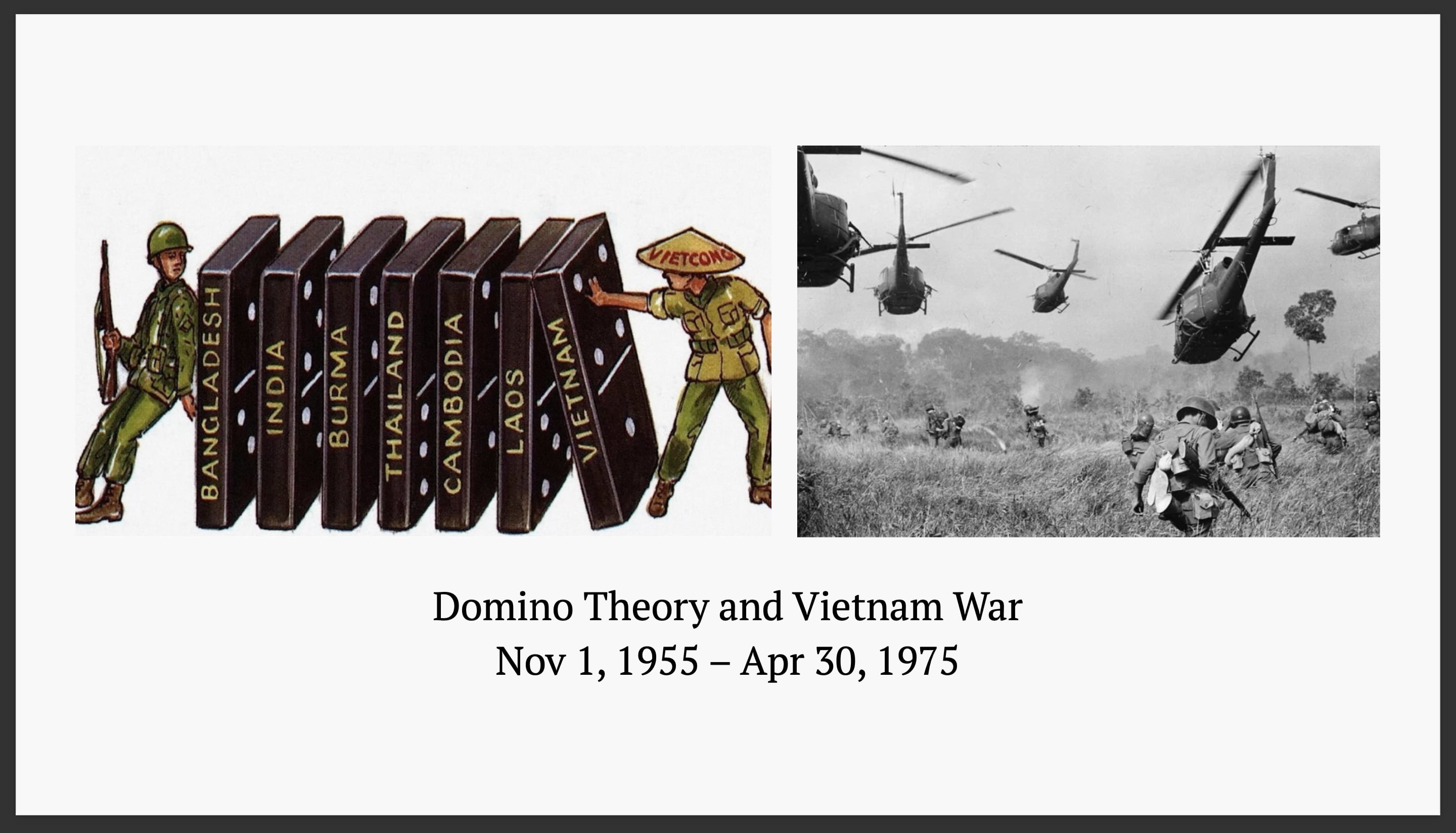

But what happened after WWII in ten years time was the Vietnam war. There was a dominant theory called the Domino Theory. The idea is that the US feared communism and they wanted to contain communism from spreading from the Soviet Union and China. They had to stop it from spreading across Vietnam because the Domino Theory stated that if Vietnam were to be lost to communism, it would spread through other countries eventually reaching all the other South Asian countries. So Vietnam was where the fight had to happen. But there were agreements in place that forbid Western countries from putting armies in Vietnam. So the US deployed military advisors, who didn’t carry guns and were supposed to teach people how to fight their own war, sort of technically bypassing the agreement. That was in 1955.

John F. Kennedy became the US president in 1961. The idea was that he was going to protect the liberal world order. I’m going to read a little bit from his inauguration speech when he took the office. “Let every nation know, whether it wishes us well or ill, that we shall pay any price, bear any burden, meet any hardship, support any friend, oppose any foe, in order to assure the survival and the success of liberty.” Which meant that the US increased spending and its involvement in Vietnam.

Guess what, when you have to fight a war you need to spend a lot of money. But the money, which was the US dollar in this case, was pegged to the gold at a fixed rate. Substantial increase in war spending, among other spendings, led to a growing budget deficit. You have massive people that were questioning the worth of the US dollar.

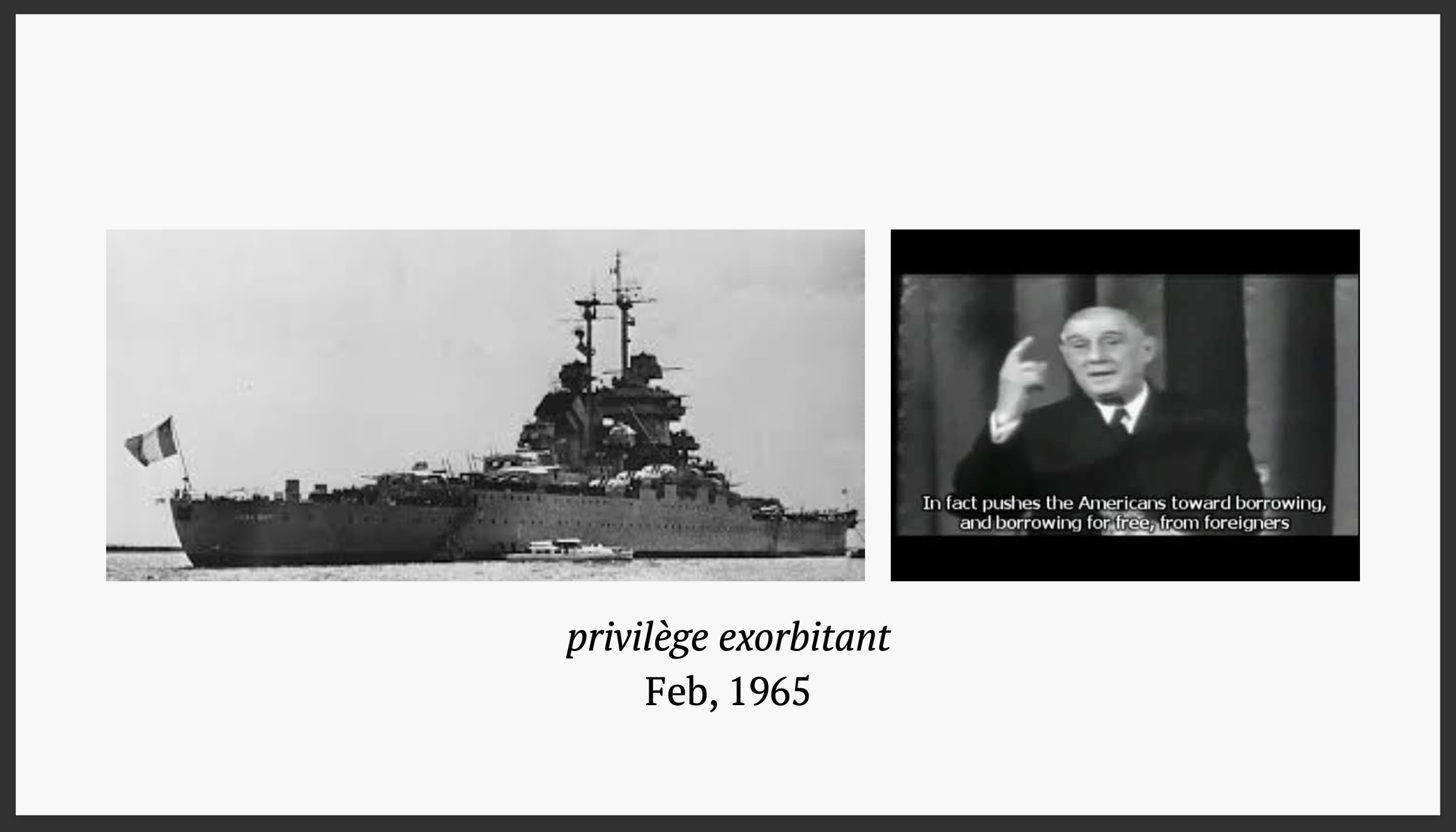

In 1965, there was this idea of privilège exorbitant. Enormous privilege was conferred to the country whose money was the international settlement dollar, allowing them to not care about trade imbalances while all other countries had to. What happened was that French warships carrying US dollars from the French treasury were sent to New York to redeem said dollars for gold from the US government. Many countries followed suit. This caused gold to exit the US. After the WWII, the US had 70% of circulating gold worldwide. With these redemptions, the US had gone down to 40% of the global gold. And you can’t have only 40% of the gold worldwide for backing the international dollar. It stopped making sense.

So with redemptions, and rampant speculative trading activities, what happened in 1971 was the Nixon Shock. Ok, everybody cools down, and from today no one can redeem the US dollars for gold. This severed the connection between the US dollars and the gold. Widespread controversy and panic ensued. What’s the worth of the US dollar now if you can’t redeem it for its underlying asset? As if it has become a game coin.

Immediately at the end of the same year was the Smithsonian Agreement. If everyone questions the worth of the US dollar, let’s devalue it. It was devalued by 8.25% at the end of 1971. And other currency were renegotiated. For reasons such as the oil prices and other things, which we will cover later, in 1976 basically everyone gave up and said ok from now on, the currency rates are floating.

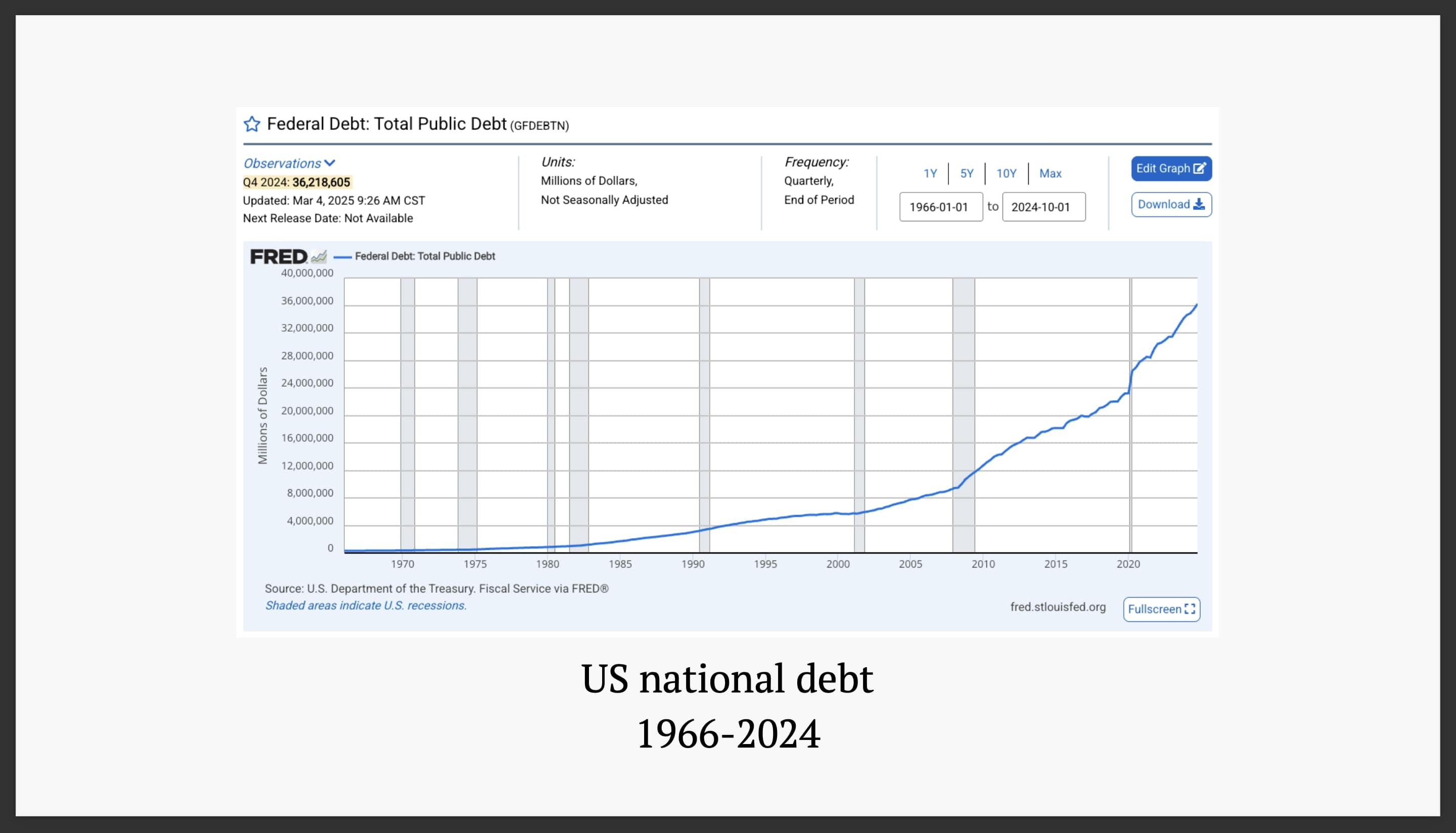

Fast forward to 2011. US debt ceiling. Imagine you are the US government. Congress has written into the law that says there is only so much debt you can bear at any given moment, so you want to be responsible and don’t borrow too much money to stay below the ceiling. What happened in 2011, which happened many times in the past, was that the debt ceiling was reached but the government needed to borrow more money from other countries. Congress said no. So the government had to start cutting all kinds of expenses. Imagine if US cannot pay back the interests on the money they borrowed from other countries. That basically means the US government is defaulting, effectively bankrupt. And if the US government bankrupts, what does that say about the worth of the US dollar? The world is going to look very different not in a very good way. So the congress was scrambled together and lifted the debt ceiling. The ceiling then sit at $14 trillion.

In 2023 the ceiling was hit again, this time at $31 trillion. What happens when you hit the ceiling is that you stop paying your medical systems and your social programs, because you cannot afford to bankrupt, so you have to keep paying other countries to maintain your trustworthiness. But the people end up suffering, particularly the people that are underprivileged.

This is a screenshot of the federal debt chart. Right now US debt stands at $36 trillion. There was an act in 2023 that froze the debt ceiling two years ago until January 2025, around the time when Trump came to office the second time. The ceiling came back. Now the ceiling has been breached already, meaning the US government is in the regime of exercising extraordinary measures - cutting down aids for poor people, cutting down social programs, including aids that go to Vietnamese families who suffered from the Vietnam war.

Petrodollar

We are switching to the topic of the petrodollar. No more gold backing the dollar. What then is the worth of the dollar?

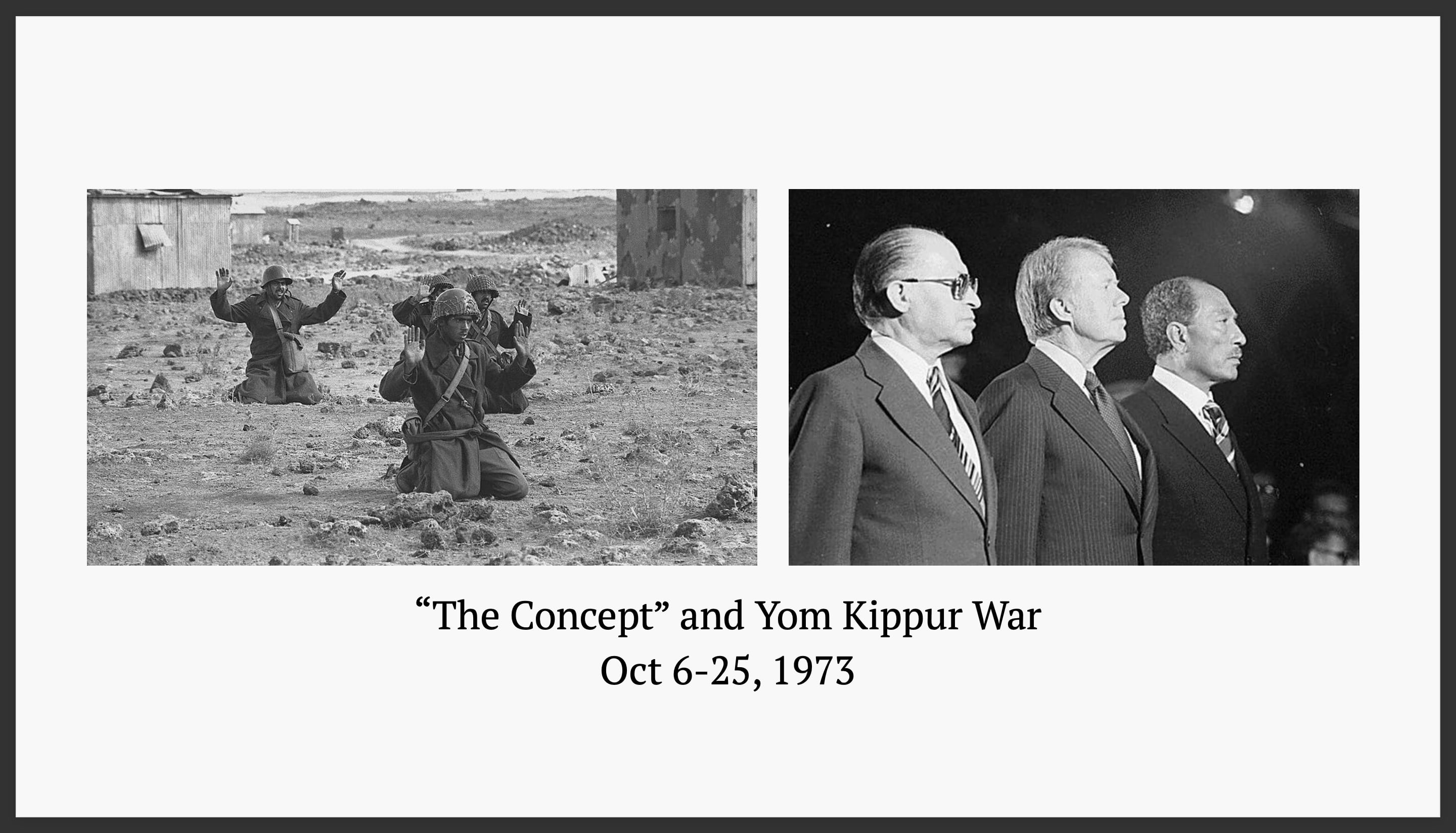

The Yom Kippur War occurred in 1973 on Yom Kippur, the holiest day for the Jewish people. For context, Israel’s intelligence and military leadership had held on to “The Concept” since Israel won the Six-Day War in 1967. The idea of The Concept is that (1) Egypt would not start a war with Israel until their air force recovers (Egypt lost nearly half of its air force on the first day of the Six-Day War) (2) Syria would not start a war with Israel unless Egypt attacks as well. The Concept turned out to be incorrect. Egypt and Syria coordinated a successful surprise attack on October 6, 1973. Israel lost around 1300 soldiers in the first 3 days.

Eventually a ceasefire was mediated by the United Nation. Then president of Egypt - Anwar el-Sadat - and prime minister of Israel - Menachem Begin - received the Nobel Peace Prize in 1978 for their efforts to create peace between their countries.

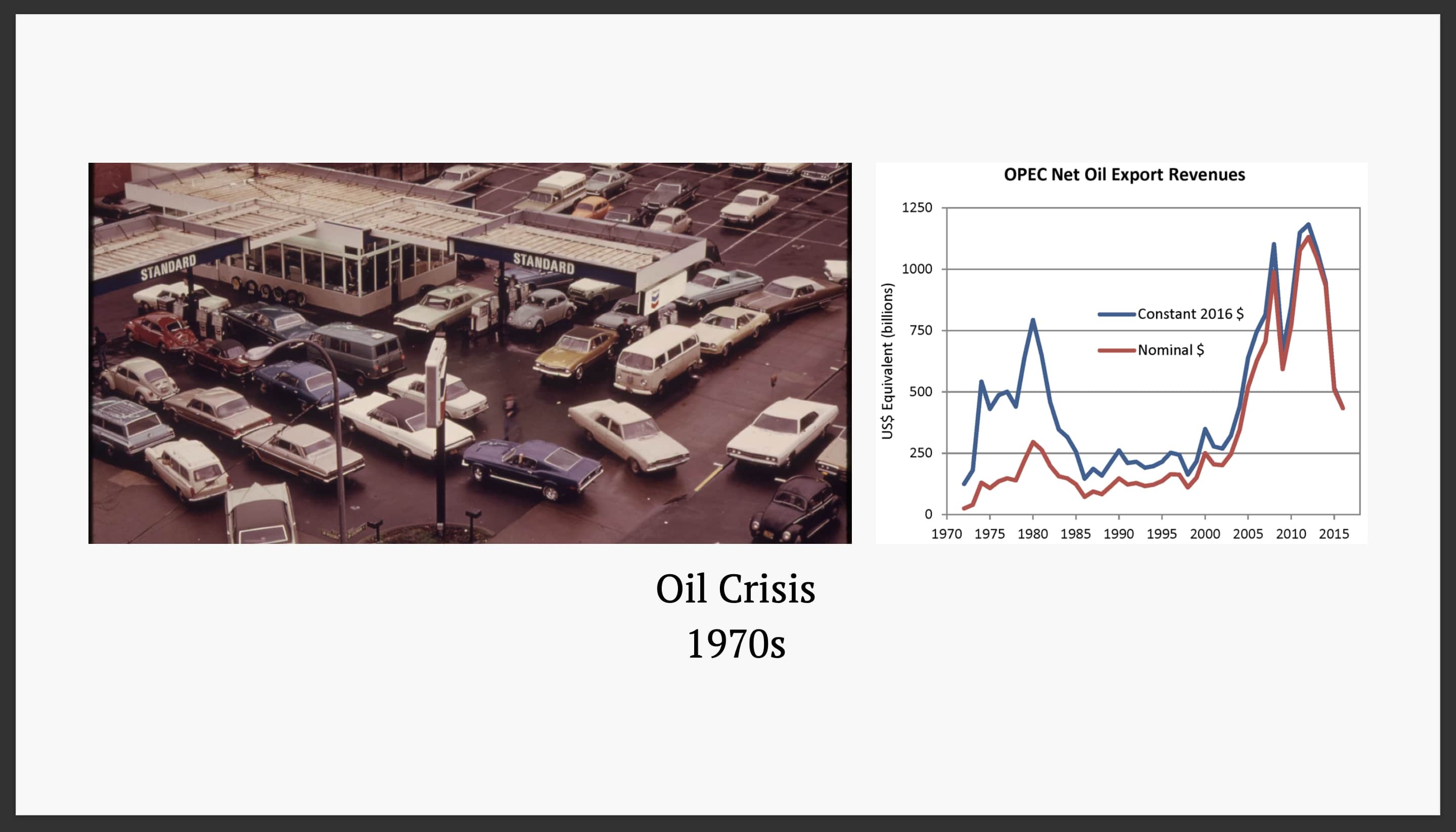

The oil-producing Arab countries (OAPEC) did not recognize the sovereignty of Israel (most of them today still don’t). In 1973, they protested against the countries that supported Israel during the Yom Kippur War by stopping the oil shipping to these countries, including the US, UK, Canada and Japan.

The US was importing 70% of its oil from the OAPEC. The oil embargo had a great impact. In 1974 oil price surged as much as 400%, from $3 a barrel to nearly $12. Cars sit idle at gas stations because there were no gas. Odd-even rationing were practiced.

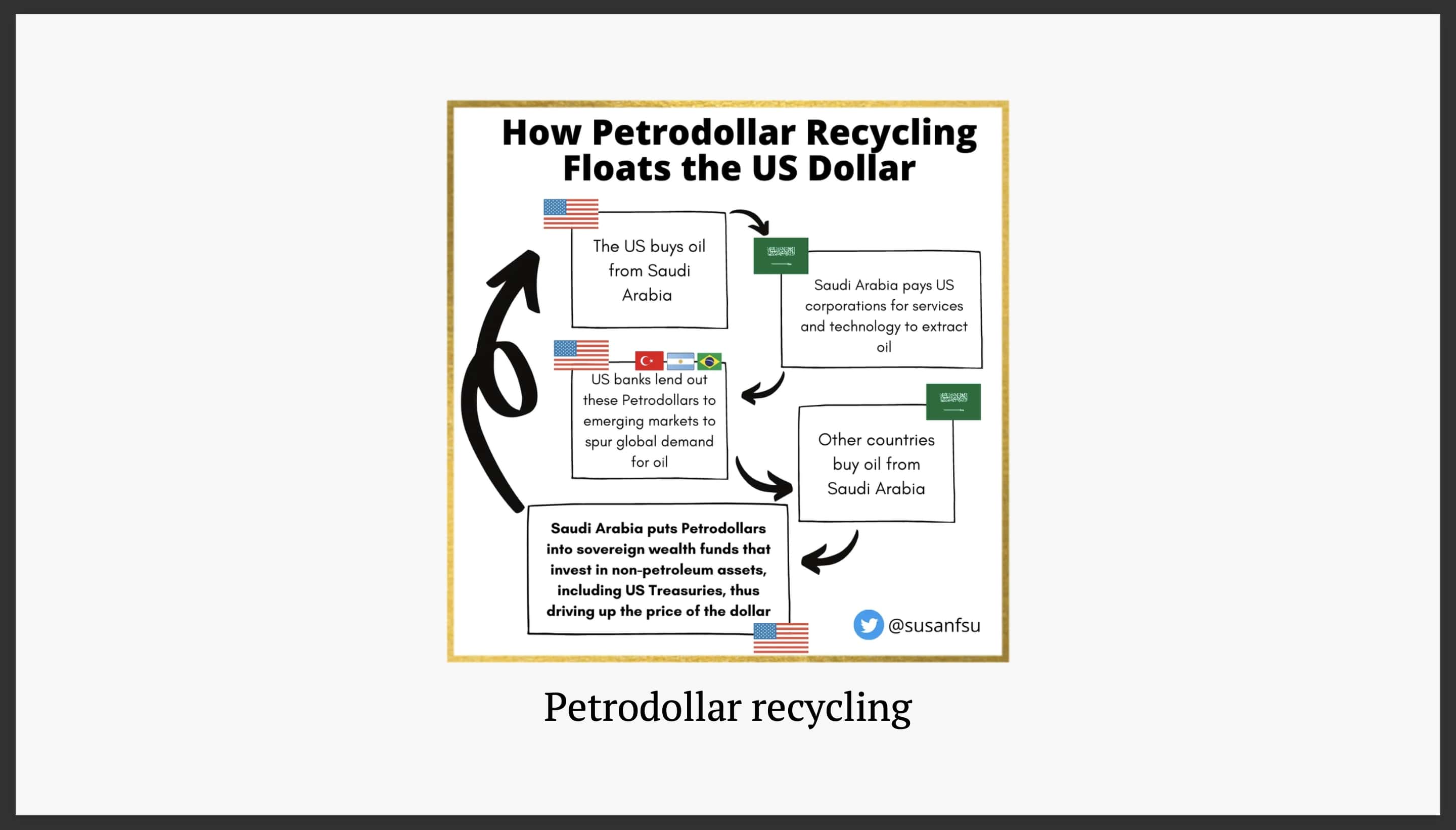

Eventually the embargo ended. However oil prices did not return to their pre-crisis levels. Wealth transfer, denominated in US dollars, continued from oil-importing nations to the oil exporters. Yet agreements were formed to create, in theory, the so called “petrodollar recycling” system.

The idea of petrodollar recycling is that Saudi Arabia would price their oil in US dollars, take the US dollars it earns through oil export and reinvest them US financial assets, primarily by buying US bonds and equipments for oil excavation. In return, the US offers military support. This created a sustained global demand for the US dollars and reinforced its status as the world’s reserve currency.

To reinforce the idea of the petrodollar system. In 2000, the president of Iraq, Saddam Hussein, unilaterally announced that their oil export would be denominated in euros, not US dollars.

Perhaps no one could really draw the causality between this dollar-severing act and the Iraq War that ensued in 2003. Official reasoning for the War was Iraq’s alleged possession of weapons of mass destruction, which was never found. After the war, the US took over the oil producing facilities in Iraq, and Iraq’s oil export returned to the US dollar for pricing and settlement.

We can see how national interests are deeply entangled in the world of currencies, which the wellbeing of many are relied upon.

Ideology vs realism

This brings us to the topic of ideology vs realism, in the context of geopolitics.

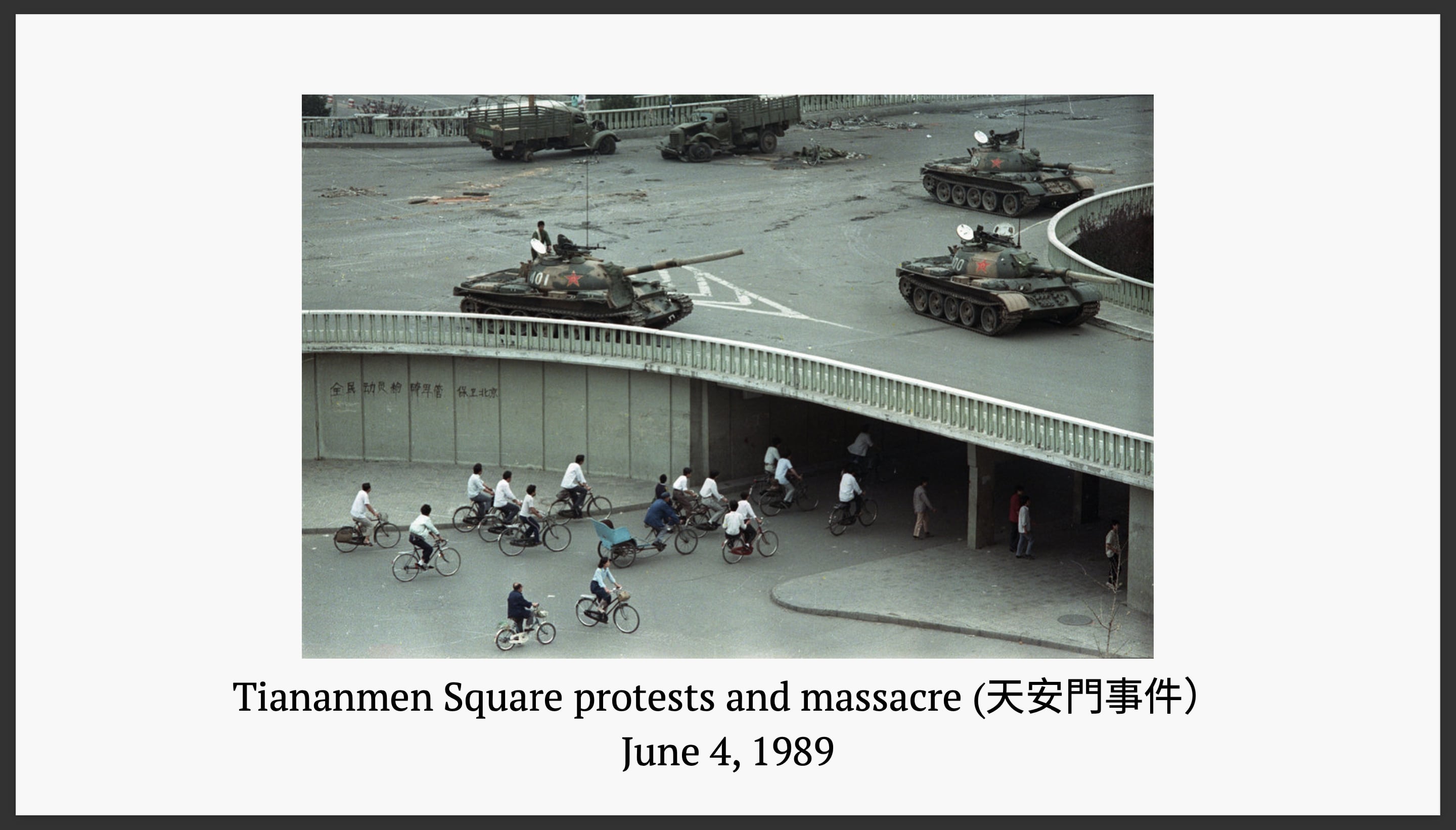

The Tiananmen Square protests and massacre transpired on June 4, 1989. Around 100,000 soldiers and 200 tanks rolled into Beijing. Estimated 3000 civilians dead.

Officially the root cause was that there were students, manipulated by the West, protesting for democracy and the rejection of the Chinese Communist Party (CCP).

What happened was that the cultural revolution ended. There were plans to transition from the planned economy to the market eocnomy. In a planned economy, prices are dictated. In a market economy, prices are driven by the supply and demand in the markets. You can imagine in the planned economy post-revolution, productivity was destroyed, commodity prices were dictated to be artificially low while the demand for these commidities was overwhelmingly strong. The transition into the market economy, if done without control, would be pretty violent. So there was a policy in place called the double-track price system (價格雙軌制). For each commodity, there would be a quota. Below this quota the price is dictated, in the planned regime. Above the quota the price is market price. Arbitrages opportunities were exploited by people with relationships with the government officials (官倒). They would buy at low planned prices and sell back to the public at high market prices. A major company co-created by the eldest son of Deng Xiaoping was involved (中國康華發展總公司). People were angry and the double-track price system was cracking. In 1988, a price reform was in the planning, where in a short period of time the planned commodity prices were to be forcefully raised to market prices on a schedule (價格闖關). Tragically, the idea of the policy reform leaked before it was implemented. People expected everything would become much more expensive very soon, so they withdrew money from the banks and began panick-buying. Banks were going bankrupt from the mass withdrawals. The price reform was never implemented. Public discontent from these events all contributed to the 1989 protests.

There is a long-standing ideology that all human beings ultimately desire and pursue the “Western” values: liberty, democracy, enlightenment and so on. All human beings eventually trend towards those values. After WWII, the US practiced the policy of containing China just like how the Soviet Union was contained. The strategy was based on the idea of peaceful evolution: due to the universal desirability of the Western values, eventually, the Chinese people would peacecfully demand democracy for China.

In 1989, the CCP condemned the US for conspiring the idea of peaceful evolution by infiltrating Chinese campuses and brainwashing the students with dangerous Western ideas.

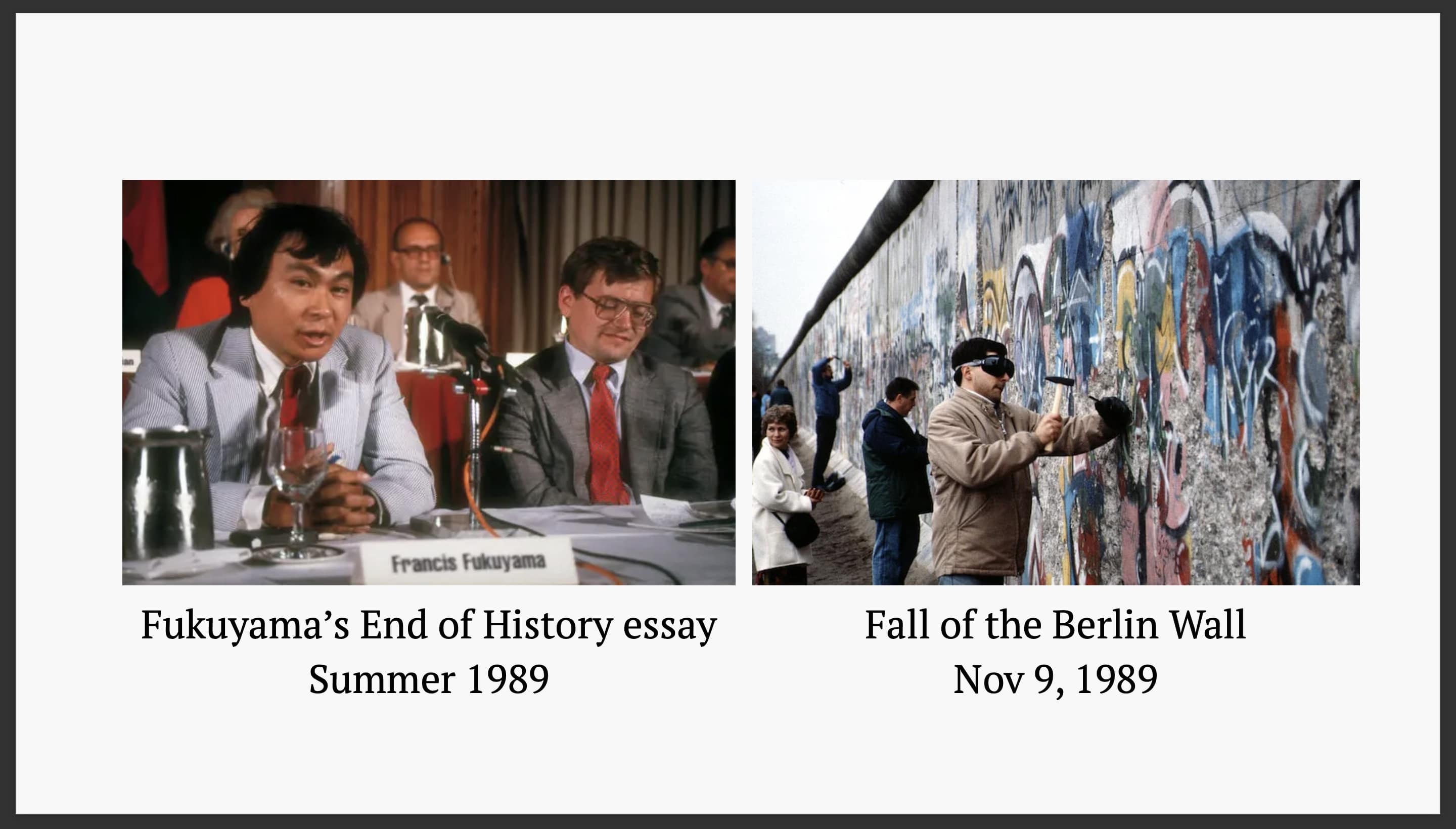

In merely two years after, a really strange essay, from today’s standpoint, was published in The National Interest. Titled “The End of History?”, author Francis Fukuyama argued that the history is ending. With the cold war concluding, the days of great ideological struggles and big wars were over forever. Romantic and ambitious people must find new pursuits. The liberal democracy has won. Moreoever there is this idea that in the world there are developed countries and developing countries. The primary goal for the developing countries is to educate their people and raise their economic standards so that they graduate to the club of developed countries, where they embrace the values of liberal democracy.

The essay came out and was not well received, but at the end of the same year the Berlin Wall fell. The essay was propelled to stratosphere.

But is it really so? Has the history really ended then? With the wisdom of the hindsight, we know that the global financial crisis (GFC) happened in 2009. What happened was that credit expanded, there were lots of money slushing around seeking returns and finding their way to real estates. The housing bubble formed and bursted. Multiple rounds of quantative easings - the minting of new US dollars into the Federal Reserve - were initiated to buy up the bad debts.

David Graeber, author of Debt: The First 5000 Years, argued that despite the US being a democracy, the financial elite of 1% wield disproportionate power in policy-making at the expense of the other 99%. The aftermath of GFC demonstrated a form of injustice where the large banks were relieved but the many bankrupted and unemployed people were left to their own devices. Graeber later became a significant figure in the Occupy Wall Street movement.

Global consensus argmin geopolitics

So we have seen many examples. When some people owe some other people money and (geo)political interests are involved, lots of people end up getting hurt badly in one way or another.

Which bears the question: can we design a global system where the influence of (geo)politics is minimized? In this system, we want no ambiguity as to what exactly has happened. It would operate as the global, canonical book of truths. Its access would be open to all without discremination. Its correctness endures even when facing the strong-arming of entites as powerful as nation states.

Let’s talk about Ethereum.

In 2014, the founders of Ethereum were living in a house in Zug, nicknamed “Spaceship”. It’s where the early codes were written and the vision was debated.

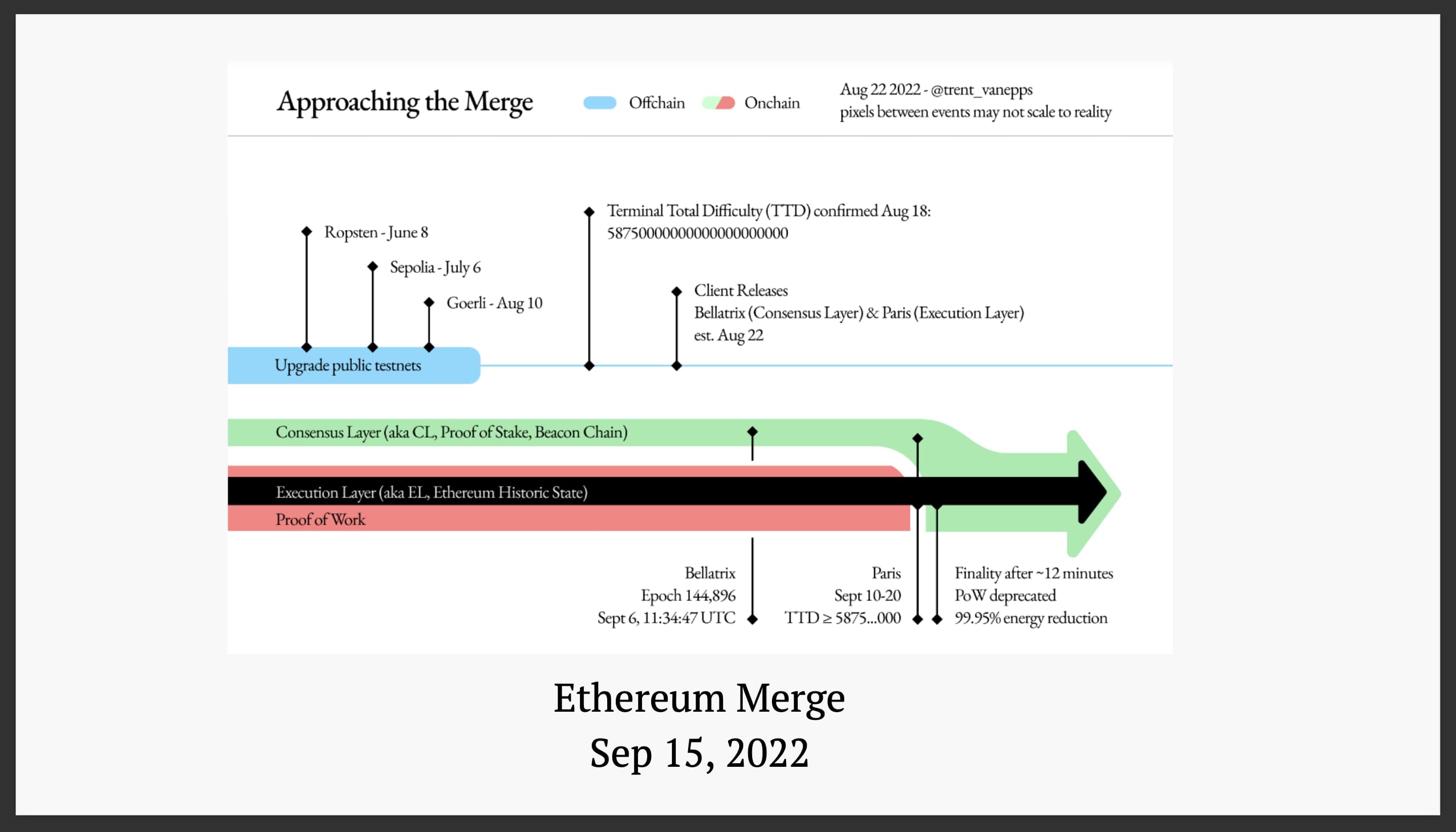

In 2022, the merge happened. The Ethereum codebase was modularized into consensus and execution client. At the merge proof-of-stake consensus clients replaced their proof-of-work predecessors.

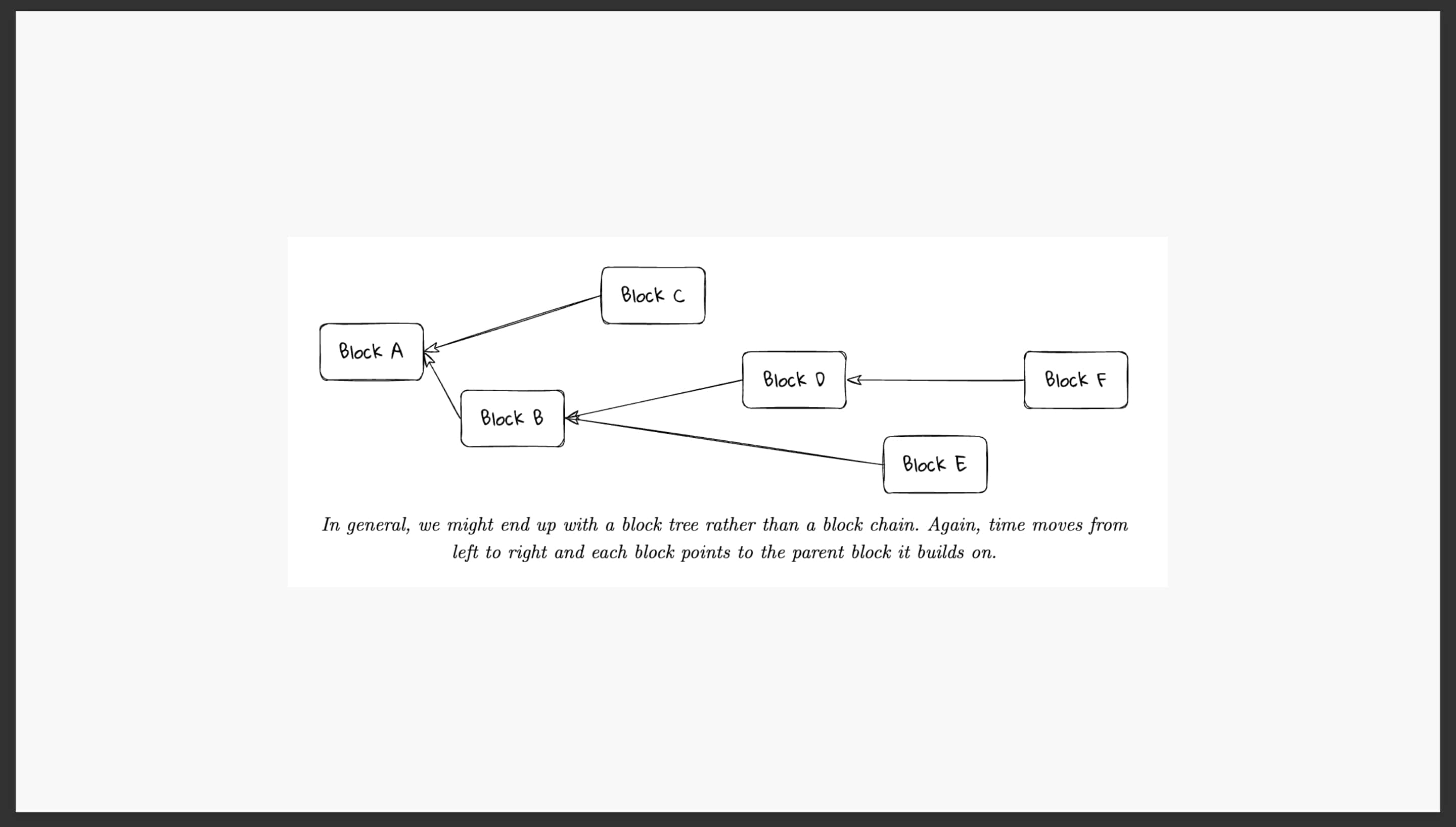

Nowadays, how Ethereum works is that we have the users of Ethereum submitting transactions, with no single entity possessing the globally complete bird’s eye view. It’s a distributed system. So the transaction log naturally looks like a tree, because the different copies of the chain would be looking at different views, and they append new blocks to their frontier (head). As these copies merge, you get a tree. But we want a blockchain, not block-tree. We want a canonical sequence of events that is agreed upon globally. How do you get that?

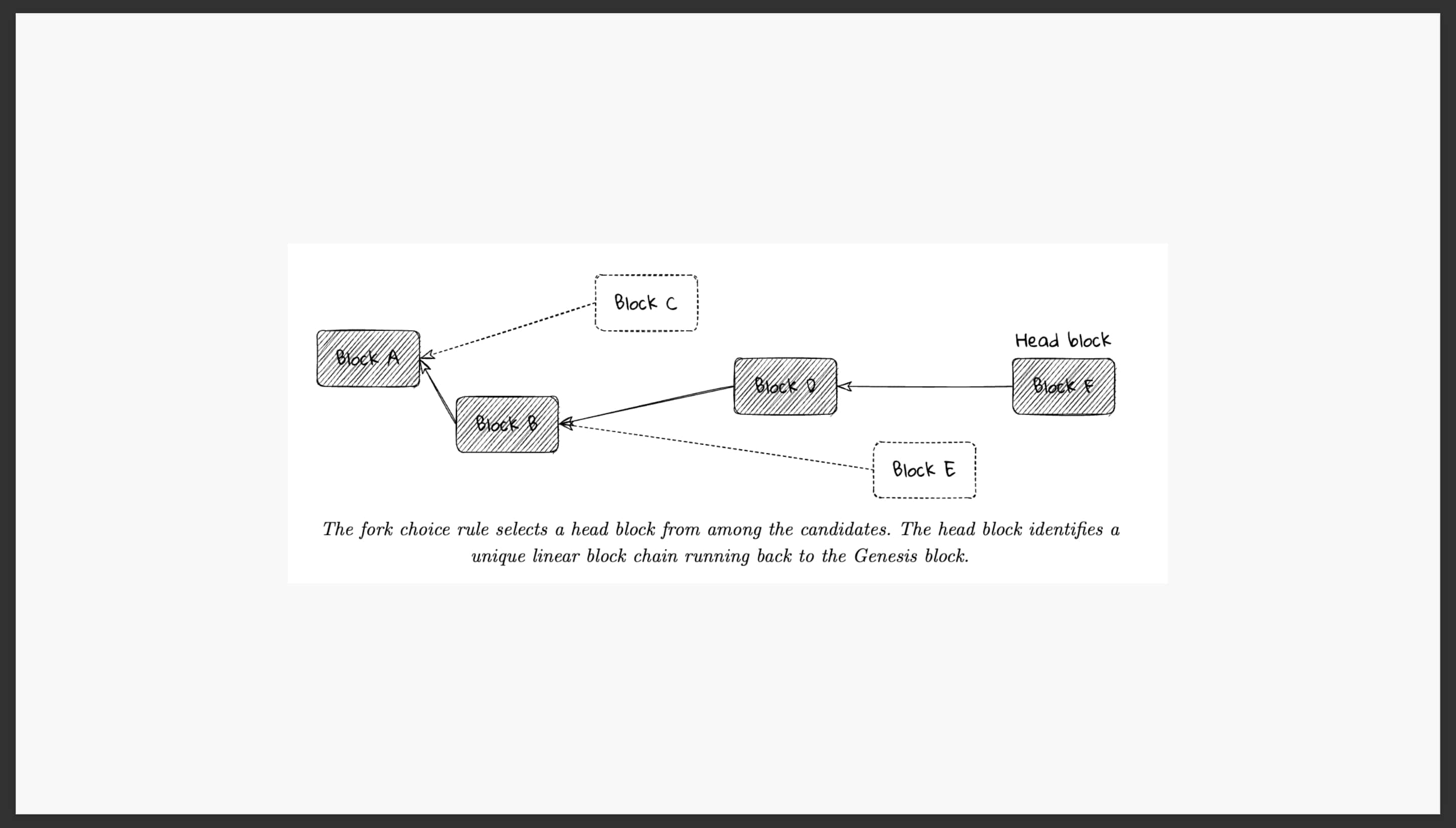

You find a linear path among the nodes of the tree, originating from its root. The algorithm to find that path given a tree is the called the fork choice rule. The outcome is you get a sequence of blocks and that’s your canonical sequence. Every (full) node of your blockchain runs this algorithm.

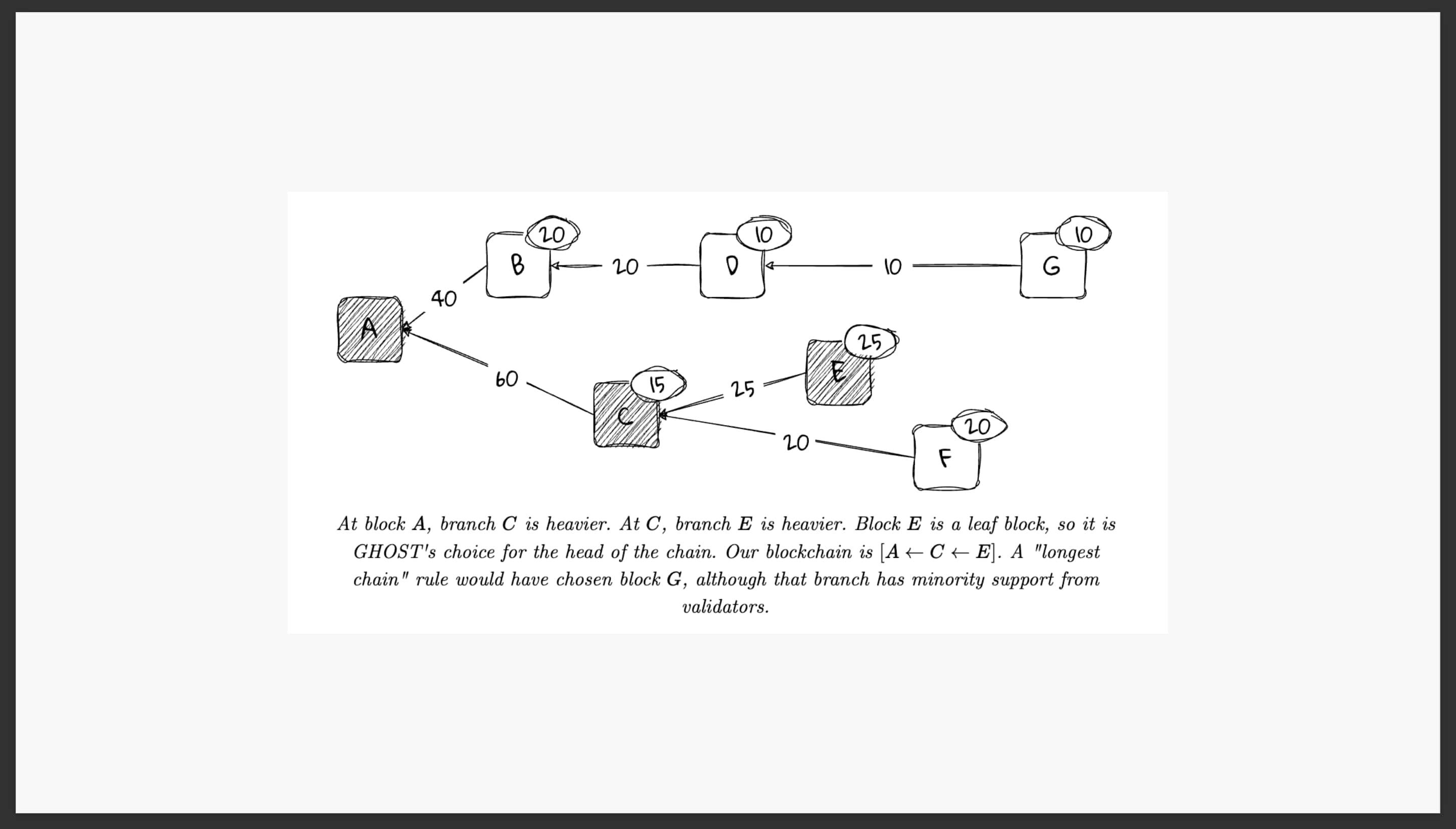

Ethereum’s fork choice rule works by the validator nodes “voting” (attesting) for blocks they saw on the network, propagated to them by their peers. The power of their vote depends on how much ETH the validator has staked into the system, so that there’s something at stake. Tallying the votes give you a score per block. The linear path is found based on these scores.

Ethereum’s fork choice rule is called the LMD-GHOST.

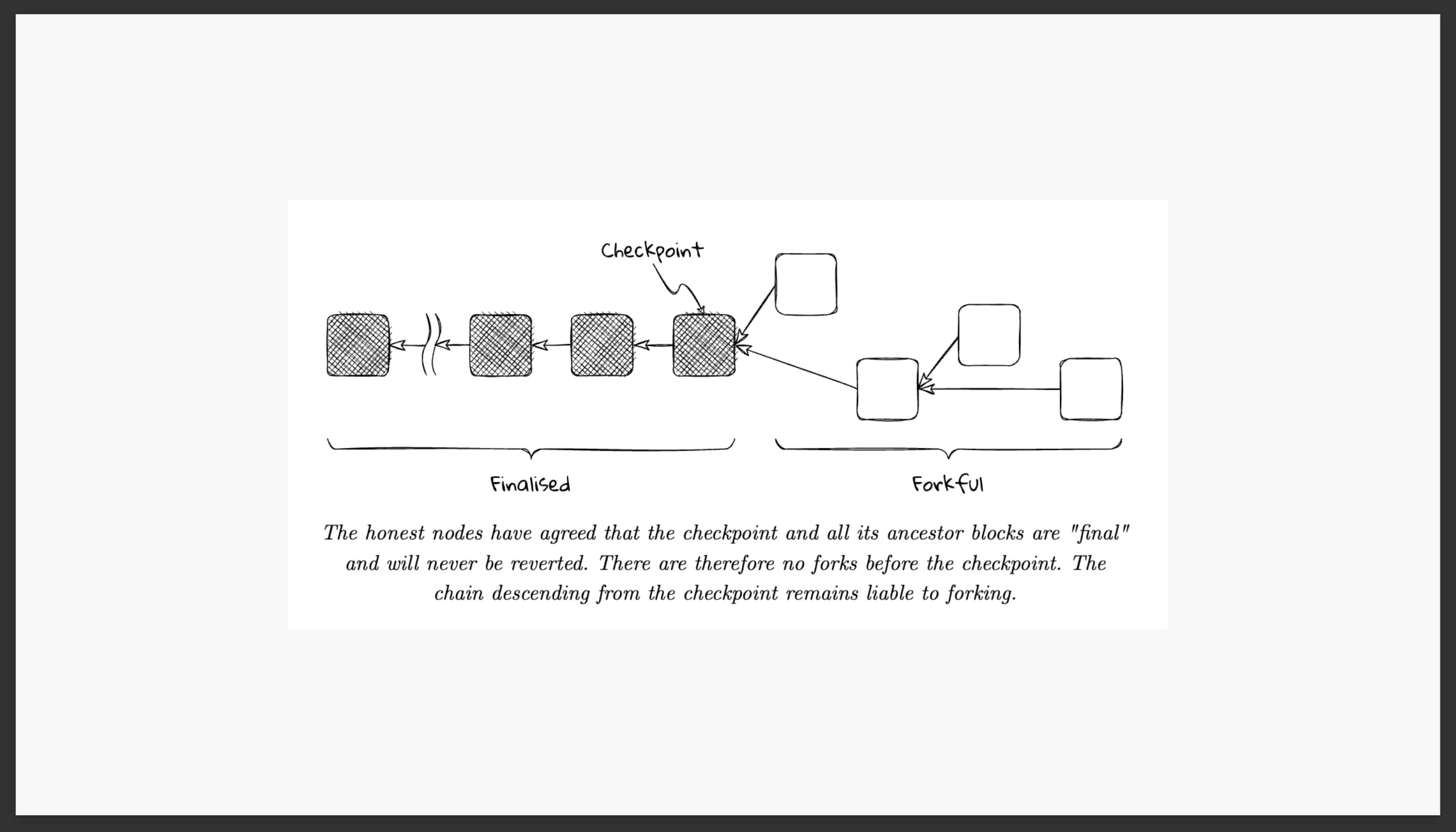

We have covered how the fork choice rule works to find a linear sequence of blocks. What Ethereum also does is it can finalize this path. Unlike Bitcoin, which strictly speaking does not really finalize things. So in Bitcoin or Bitcoin-like systems, you can have drastic shift from a linear path to another linear path because some minders were mining many blocks in secret with superior hash power. This is undesirable, because the users don’t have the strict guarantee that what’s onchain will stay there forever. It’s a problem of probability. That’s why Bitcoin recommends a 12-block waiting time.

The post-merge Ethereum provides finality. What’s finalized is final, they will never change, based on the underlying cryptoeconomic guarantees. Ethereum uses an approach that essentially is just a variation of the two-phase commitment.

Ethereum’s finality algorithm is called the Casper FFG. So Ethereum has LMD-GHOST* looking at the tree and picking the linear path up front, like the explorative tendrils of a starfish, and Casper FFG following closely behind to produce the finalized, ossified path.

*LMD-GHOST has to be modified to work with Casper FFG, so that instead of finding a path that originates from the tree root (genesis block), it originates from the latest finalized block by Casper FFG.

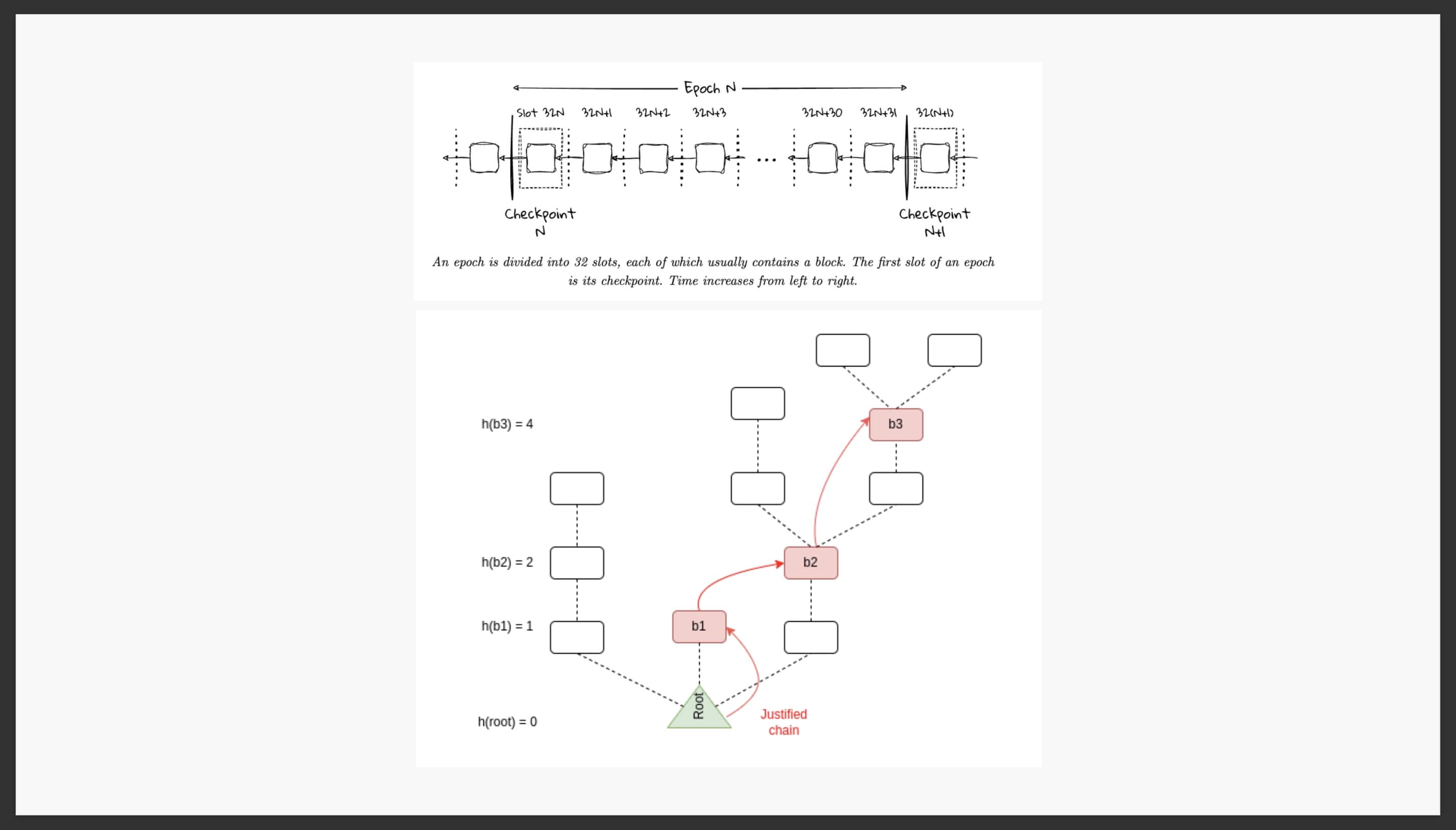

The temporal structure of the Ethereum blockchain consists of slots and epochs. A slot is the basic unit of time, where a single block happens. 32 consecutive slots form a single epoch.

If a supermajority of validators attested to a block, that block becomes “justified”. If I, as a block, have a child block that is justified, I become double-justified which simply means I become finalized.

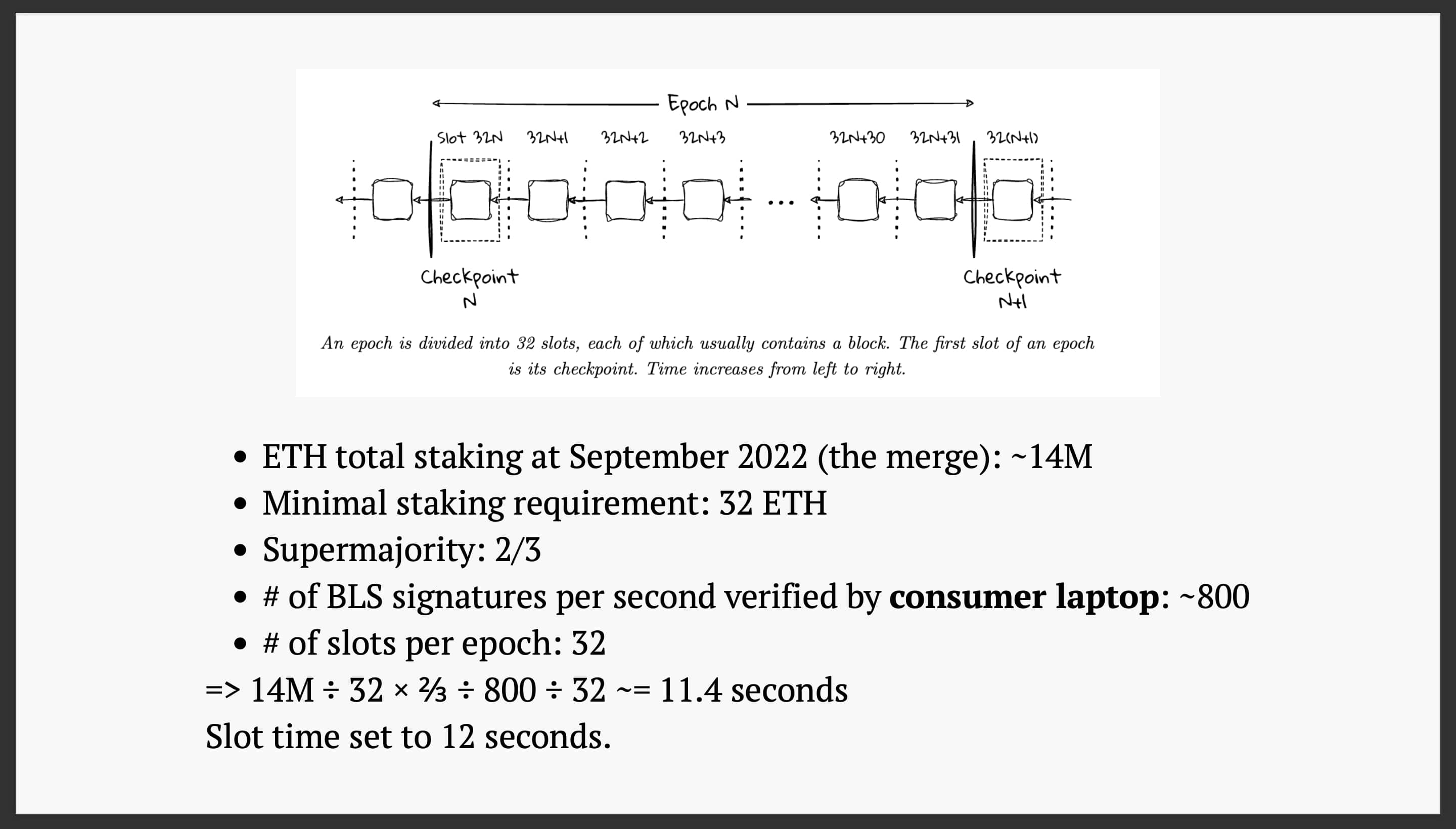

I want to specifically point out that the choice of these numbers is not arbitrary.

Ethereum’s slot time is set to 12 seconds. Why chose 12? We can through an estimation:

- Back in September 2022, the total amount of staked ETH was about 14 million.

- A validator must stakes minimum 32 ETH to qualify. So the maximum amount of validators is 14M/32.

- Supermajority is two thirds. So a block needs to get 14M/32*2/3 (~291600) attestations to become justified.

- For home stakers, they must stay caught up to the tip of the blockchain. This means a consumer laptop needs to be able to verify the attestations of a justified block within one slot time. To verify an attestation largely means to verify a BLS signature attached to it. So a home staker needs to verify 291600 BLS signatures per slot time.

- How many BLS signatures can a consumer laptop verify in a second? About 1000, according to my benchmark in Go. Let’s give it a 20% margin. So 800 per second. This means a consumer laptop can work with a 14M/32*2/3/800 (~365 seconds) slot time.

- However, a 365-second slot time is not very useable. One must wait about 6 minutes of a spinning circle for just the earliest sign of transaction confirmation. So Ethereum divides up the validators into 32 groups, and distributes the attestation job across 32 slots, one group per slot. The amount of signatures to be verified per slot becomes 14M/32*2/3/32 ~ 9110. The slot time acceptable by home stakers become 9110/800 ~ 11.4 seconds, which gets us very close to 12.

The keyword here is “consumer laptop”. Ethereum wants consumer laptops to be able to participate directly in its consensus process. I think one part of the motivation is that Ethereum wishes to minimize geopolitical influence in its system. So it wants the little guys to be able to participate directly.

If you have a system that requires the big guys to work, you are tying your system correctness to the relatively affluent participants, whose population is very unevenly distributed in the world. In short, you would not be minimizing geopolitcal influence in your system then.

I think these design choices really illuminate what Ethereum is designed for.

Empires

I want to end the talk about the idea of empires.

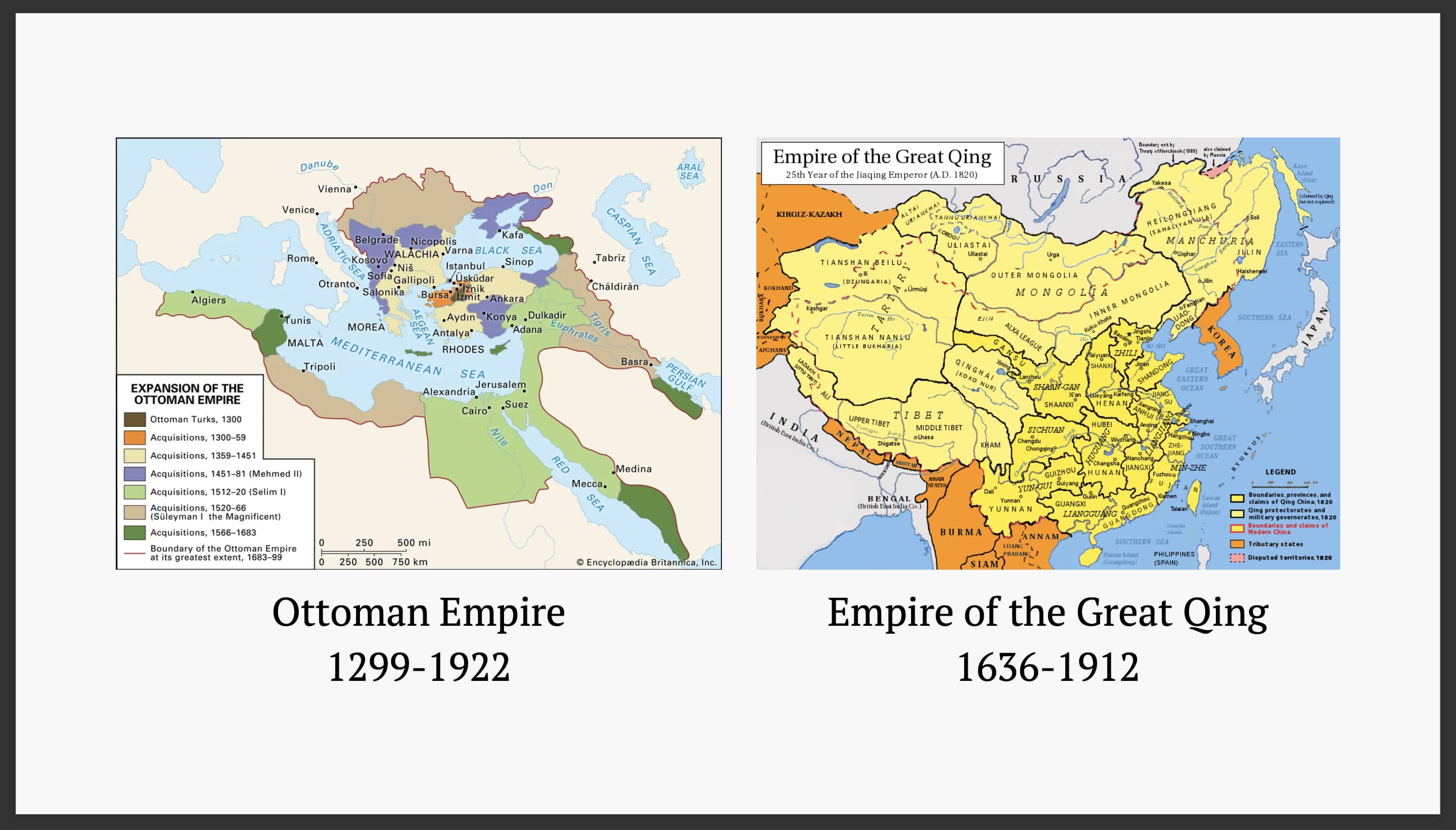

Historically, empires come and go. The Ottoman Empire last about 600 years. The Qing Empire lasted about 300 years. They don’t tend to last forever.

This comes from the Foundation series by Isaac Asimov. There’s a galactic empire that governs the entire galaxy. I thought it might be interesting to read a little bit from the book itself, what happened to this great empire, specifically to Trantor, the central governing planet:

Time had been when the insubstantial ribbons of control had stretched out from its metal coating to the very edges of stardom. It had been a single city, housing four hundred billion administrators; the mightiest capital that had ever been.

Until the decay of the Empire eventually reached it and in the Great Sack of a century ago, its drooping powers had been bent back upon themselves and broken forever. In the blasting ruin of death, the metal shell that circled the planet wrinkled and crumpled into an aching mock of its own grandeur.

The survivors tore up the metal plating and sold it to other planets for seed and cattle. The soil was uncovered once more and the planet returned to its beginnings. In the spreading areas of primitive agriculture, it forgot its intricate and colosal past.

Empires don’t tend to last forever. But I’m not trying to say that we should be looking at empire-like countries of our world and consider they may be expiring. For American people maybe they should really think about the finitude of being and the problems they face collectively. Complacency is dangerous. But more importantly for Taiwanese and all these other countries that are dependent on the empire in place. We have the US dollar that denominates a lot of the world economies. So this is about the well-being of individuals and systems that are relying on a stable world order.

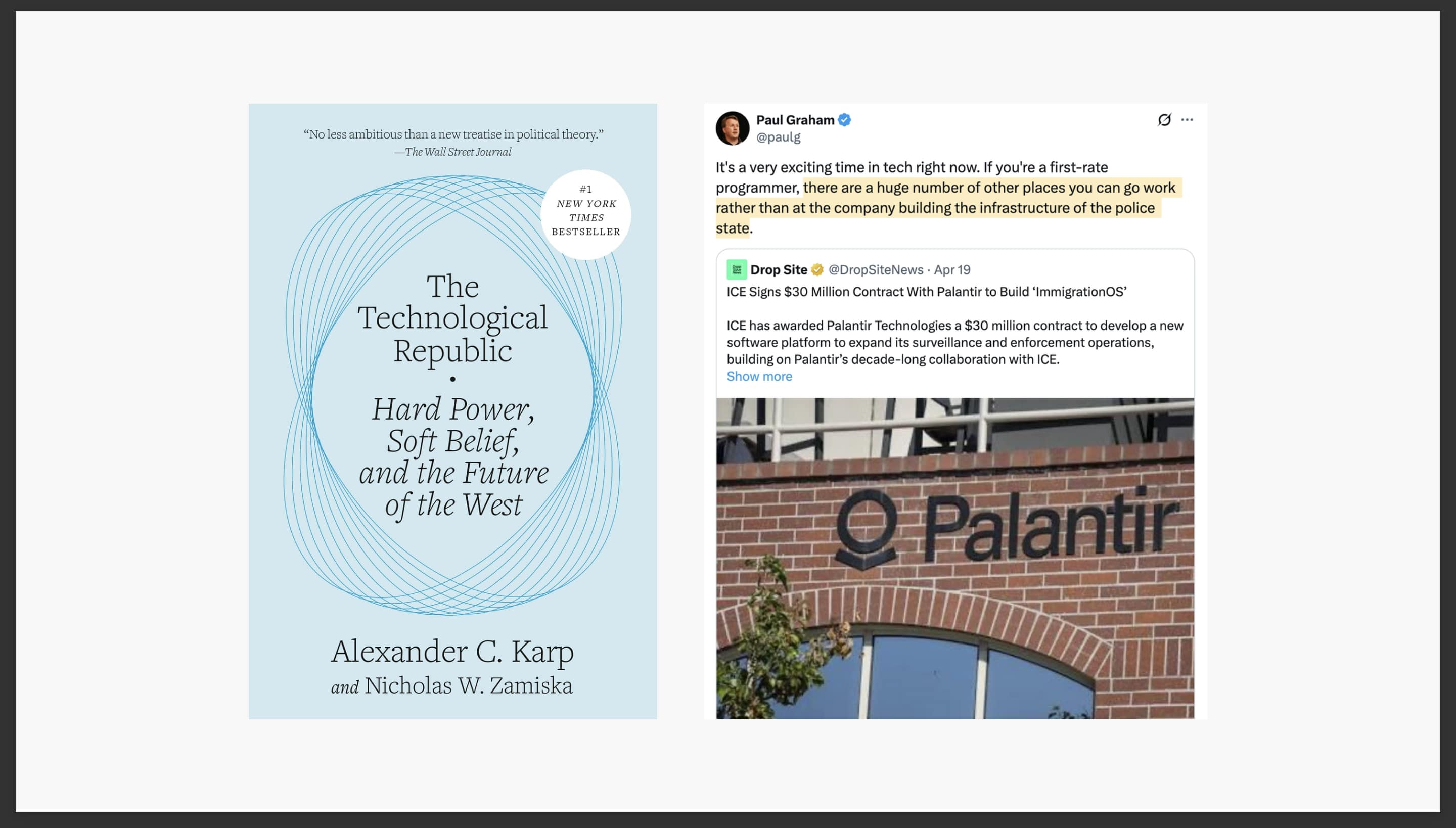

I want to end the talk in this. This is a book published by Alex Karp and his colleague at Palantir. Palantir is a Silicon Valley startup founded about two decades ago. The main idea of the book is that digital technology is powerful and it should contribute to the protection of national interests, specifically the American ones. Palantir works closely with the US military to provide actionable intelligence and recommendations to the soldiers on the ground.

On the right, this is a heated discussion that happened on Twitter less than a month ago. Palantir started working with the US immigration office to apply their technology to real-time identification of those who overstay their Visas so they can be deported as soon as possible. Paul Graham of Y Combinator said that talented programmers have many avenues to invest their talents rather than working for the police state.

I’m not here to argue for one side or the other. The point here is, it has been proven that the history has not ended after all.

We are at a very interesting time in 2025. We are seeing rising nationalism and receding globalization. It’s clear that the history is still going. I hope this talk has demonstrated to you that blockchain was invented with censorship resistance against actors as powerful as nation states. Clearly this is a kind of system that is participating in the evolution of our time.

So I think that as you are learning about how blockchains work and how to build applications and so on, this is actually much more than choosing a career. Whether you like it or not, blockchain is participating in the evolution of the world order in front of our eyes. And I think especially in stable times, your actions have outsized influence in the world.

But I think the most dangerous thing is that we forget about the history, and we make the same mistake. We don’t have a very good brain. “We have Paleolithic emotions, medieval institutions and godlike technology.” If we forget about the past, we’ll probably be repeating our mistakes, and the future prospect won’t be very good.

Lastly, I’m not suggesting any particular views or manipulating you into particular beliefs. My intention is to present what I see, as objective as possible. I hope that every one of you would be open-minded, develop your own view of where the world has come from and where it is going, and from that view you get to choose your path with wisdom.